Make Your Money Matter

Socially responsible investing for beginners

Socially responsible investing (SRI) – also referred to as ethical investing – puts your money to work in investments that aim for good returns while considering values and societal concerns. It’s all about choosing to invest in companies or funds that do good in the world—whether that means caring for the environment, treating people fairly, or having strong ethical standards. SRI can be an effective way to grow your wealth while supporting the causes that matter to you.

Why SRI?

Socially responsible investing (SRI) isn’t just about the ‘feel good’ factor. It’s a solid strategy to build wealth too. Like traditional investing, SRI aims for long-term financial growth through compound interest. Many SRI funds have outperformed non-SRI counterparts, with data from the Responsible Investment Association of Australasia (RIAA) supporting this. According to RIAA research, responsible funds in both the New Zealand and Australian markets have shown higher returns compared to mainstream funds. SRI is gaining momentum in NZ, where assets invested using a leading approach to responsible investment now make up almost half of the total market (49%). Companies and funds are increasingly embracing ethical practices, ensuring long-term sustainability and potential returns.

Find your cause

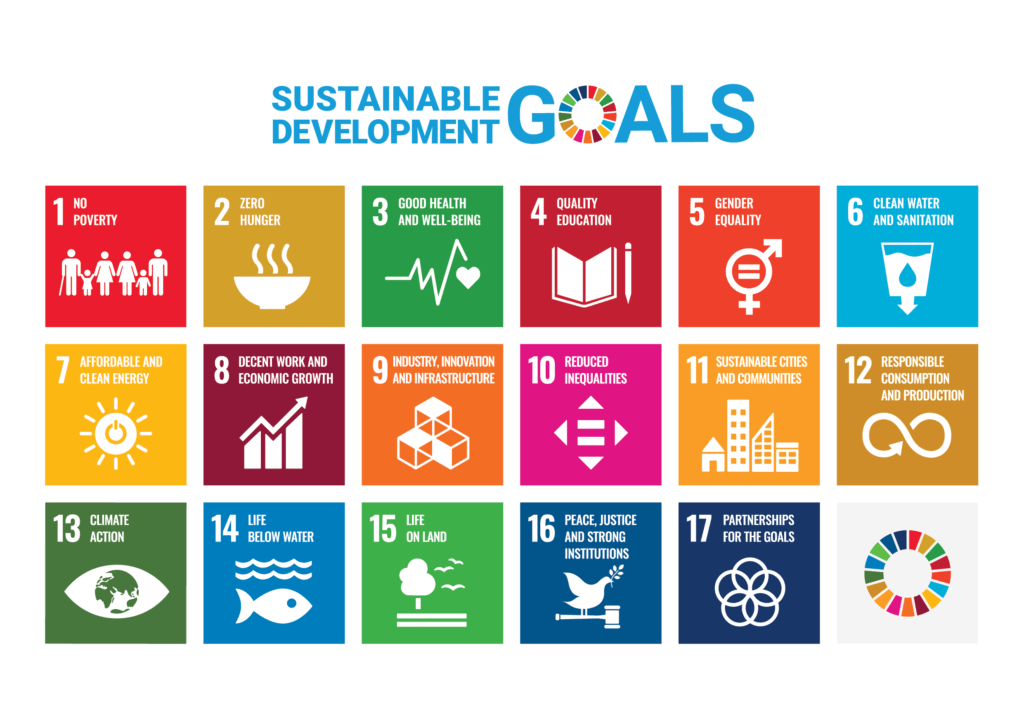

Socially responsible investing means different things to different people, so it’s important you consider what ‘ethical’ means to you personally. While mainstream investing focuses on numerical data and financial metrics, SRI allows you to engage both your heart and mind. Before you dive into the world of SRI, be clear about your personal values. A good place to start is by exploring the UN’s 17 sustainable development goals, covering everything from clean energy to gender equality. Identify the goals that resonate with you most. Look for companies that are committed to these goals, which might be evident in their mission statements or fund mandates. Whether it’s clean energy, affordable housing, or animal rights, there’s an SRI option for you.

Get familiar with the types of investments available

There’s no single “best” SRI investment type that works for everyone because it depends on your individual goals and risk tolerance. With so many choices, it’s important to do your homework and consult a financial adviser. Some popular SRI investment types in New Zealand include:

Ethical Managed Funds and Exchange Traded Funds (ETFs) – A portfolio of assets (kinds of investments) that are chosen by a fund manager. Many new investors opt for ethical EFTs because they allow you to diversify smaller sums of money more efficiently.

KiwiSaver Funds – Most KiwiSaver funds have some ethical considerations. Some exclude certain industries, activities or types of investments, while others specifically invest in sectors or companies that have positive (or not negative) impacts.

Ethical Shares – An ethical share (sometimes called a stock, equity or security) is a slice of a company that adheres to specific environmental, social and governance (ESG) principles. Owning these units means you own part of that company and can enjoy a portion of the profits it makes.

Green, Sustainability or Social Bonds – When buying a bond, you lend money to a government, council or company, and you’re paid a certain interest rate in return. It’s important to know what the money will be used for (e.g. to fund a project like a wind farm), what the projected impact on people and the environment is, and how it’s reported on.

Maximise returns while making a difference

There’s an array of SRI products that let you grow returns while making a positive impact. These products commit to analysing non-financial factors before investing in a company. Some explicitly exclude certain kinds of companies, like fossil fuel and tobacco manufacturers, from their portfolios through “negative screening.” If there’s a business type that doesn’t sit well with your moral or environmental values, the team at Blue Canoe can help you seek out funds that actively avoid those companies. Some of the KiwiSaver funds that meet high ethical standards can be viewed here. And some of the investment funds that meet high ethical standards can be viewed here.

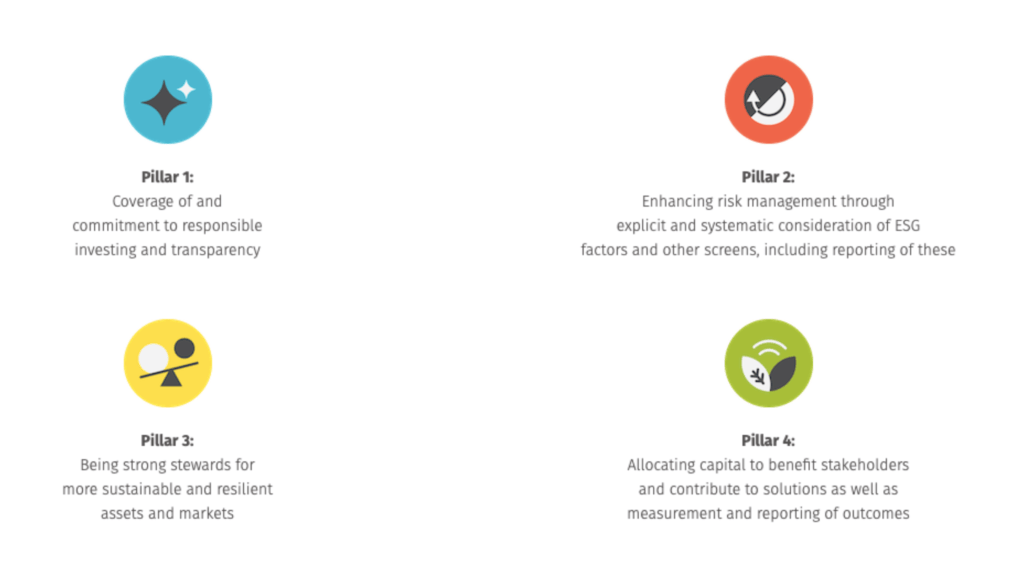

We partner with ethical fund managers who are certified by the RIAA and have frameworks in place to filter out investments that might be considered unethical. The fund managers we work with are assessed using RIAA’s Responsible Investment Scorecard, covering the four key pillars shown below.

Make informed decisions

If you’re new to SRI, staying informed through insights and expertise will improve your decision-making. Seeking expert guidance from a financial advisor with specialist knowledge in SRI can simplify your fund selection process and help you manage risk, as the value of your investments fluctuate.

It’s also crucial to keep up to date with factors impacting your investment portfolio. For example, if you’re passionate about clean energy and have invested in solar energy, keep an eye on industry trends, emerging technologies and regulations that could influence the trajectory of your investment.

As the SRI movement continues to gain momentum, it’s a smart way forward for mindful investors. Success relies on a clear purpose, ongoing awareness, and a balanced approach to managing your portfolio. Whether you’re gearing up for retirement, have received a cash lump sum, or you want to make your accumulated savings last, we’re here to help. We can assist you in building an investment portfolio that resonates with your values and provides good returns at a level of risk you’re comfortable with.

Let’s explore how you can make a positive impact through your investments! Get in touch today.