The Pros And Cons Of Adding Investment Property To Your Financial Plan

Including investment property in your long-term financial plan can set you up for success. Investing in property has always been big in New Zealand but, like any investment, it’s smart to weigh the pros and cons before diving in.

When you put your money into property, you can’t quickly cash out whenever you like. It usually means selling the property or taking out a bigger mortgage to access your money. Investing in property is not a quick win—but for those in it for the long haul, it can be very rewarding.

Before you jump in, do your homework. Check out the market, look into property reports (like LIMs), and figure out what you’d be comfortable losing if things go south. And if you’re thinking about renting it out, decide whether you’re up for managing a property. Taking the time to look into these things and getting expert advice can help you make smart decisions that match what you want from your money.

Property Investment Pros

1. Capital gains

New Zealand property markets have historically enjoyed moderate long-term growth. There will always be ups and downs but over the long-term property continues to be one of the best investments you can make.

When a property sells for more than what you paid for it, that extra cash is what we call capital gains. These gains can happen for various reasons—like the area’s value going up, improvements you’ve made, changes in the neighbourhood, or just general shifts in the economy that affect property values.

Whether you’re looking at renting it out, turning it into an airbnb, or snagging a doer-upper to renovate and sell, a savvy property investment lets you ride the wave of these capital gains over time.

2. Passive income

Rental properties are one of the most popular forms of property investment in Aotearoa. Investing in a rental can help you to create a passive income while owning an asset that grows in value over time. Tenants pay a good proportion, if not all, of your outgoings like mortgage repayments, rates and maintenance while the property (hopefully) appreciates in value. And if you decide to hold onto your rental once the mortgage is paid off, you’ll have an income stream in years to come that you can adjust with market rents and inflation.

But the numbers simply have to stack up! Remember, your investment will not be your family home, so put your emotions to one side. When starting your search, work out what you can afford and check out areas that are already generating good rental yields or where there’s a high demand for rental properties. An ideal property will likely be low maintenance and close to parks, schools, transport and shops.

In some cities, finding a rental property that’s a money-maker from day one might be like searching for a needle in a haystack. So, think about checking out other areas and set a rent that makes good economic sense. Crunch the numbers—mortgage payments, interest rates, and potential market ups and downs all play a big part in deciding if an investment is a win. It might not lead to immediate profits, but if an area shows promise, you could be looking at a passive income down the line.

3. Investment diversification

Diversification is key in a solid financial plan. Adding real estate to your investment mix spreads out the risk across different assets. Real estate often moves independently from share markets, acting as a safety net when markets get shaky. Unlike shares that can go up and down a lot, property values tend to stay steadier over time. And for those in a position to invest in multiple properties, diversifying across different areas enhances your portfolio’s resilience. This strategy broadens your exposure to the market, reducing reliance on a single location.

4. Leveraged equity

Property is one of the few types of investments in which you can borrow money to reach your long-term financial goals. If you own your home, you might be able to tap into the equity you’ve built up as a deposit to invest in another property. Equity is what you own in your home minus what you owe on the mortgage. For instance, if your home’s worth $900,000 and you owe $300,000, you’ve got $600,000 in equity. Depending on your situation, you could use a chunk of this equity to kickstart an investment in another property.

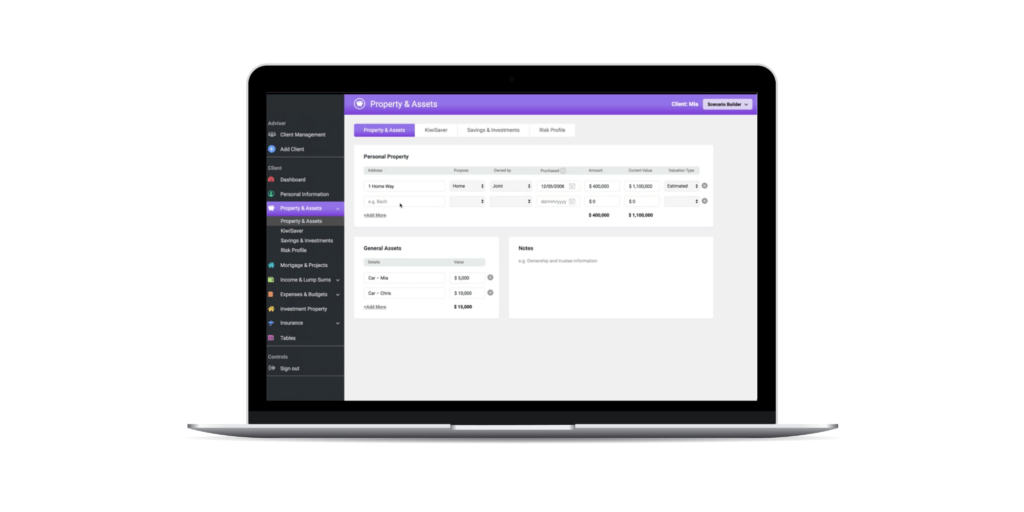

However, getting a loan isn’t just about equity. Your bank will consider factors like your income and how much rent the new property might bring in. At Blue Canoe, we use detailed information about your existing assets to help remove the guesswork. We’re able to model changes to show what impact property purchases, renos, upgrades and sales would have on your financial situation now and in the future.

Property Investment Cons

1. Upfront costs

Investing in property often demands more substantial upfront costs compared to other long-term investments. When purchasing property, you’ll typically encounter initial expenses for building inspections, legal fees, and potentially additional costs for maintenance or renovations, in addition to the initial deposit.

2. Property management

Property investment usually involves more work than saving money in the bank or investing in shares and managed funds. Most investors spend a lot of time looking for suitable properties to buy, finding and managing tenants, arranging for maintenance work to be done, and ensuring legal compliance. Managing these aspects can be time-consuming and may require hiring property managers, affecting your overall return on investment.

3. Tenant risk

Tenant risk in rental properties boils down to potential headaches caused by tenants. This includes scenarios like tenants not paying rent, damaging the property, or breaking tenancy rules. Having the property sitting empty can also be stressful, affecting your cash flow.

To dodge these problems, finding good, reliable tenants who pay on time, take care of the place, and follow the rules is important. Conduct reference checks, check rental histories, and set clear rules in tenancy agreements. Staying in touch with tenants and dealing with issues fast helps cut down on these rental property risks. It’s a good idea to budget to allow for any potential loss in rental income from having a vacant property.

4. Tax rules and regulations

Owning a residential investment property has tax implications. Income generated from rent is taxable, which means you’ll need to complete a tax return each year. Gains from the sale of a property may also be taxed, which can affect the profitability of your investment. Currently, if you sell a residential property that’s not your main home and you’ve owned it for less than 10 years, you may have to pay income tax on any gain on the sale. This is known as the bright line property rule.

Tax rules often change and can be complex, so it’s essential to get professional guidance from an independent financial adviser or accountant. You can also find out more about current NZ tax rules and regulations on the IRD website.

When done right, investing in property can significantly contribute to your financial success and security in the years to come, but making an informed decision about whether it’s the right fit for you requires careful consideration and research.

If you decide that investing in property directly isn’t your thing – but you’d still like to reap the benefits of property ownership – there are indirect ways to invest. Managed funds that deal in commercial property offer a hassle-free alternative. Plus, some KiwiSaver funds include commercial property in their investment mix.

At Blue Canoe, we’re here to help you to realise the future you want, and build a clear plan to get you there. We offer expert, data-driven investment advice across a range of investment products including property, managed funds, shares and bonds, ensuring your investments meet your evolving needs.

Get in touch to explore your investment options today.